SAP S/4HANA offers the ideal platform for achieving a higher level of automation. LAPP migrated to SAP S/4HANA in January 2021 and is therefore prepared for the future with even faster data access and thus improvements in data recording and reporting. The foundation has been laid for high-performance, easy-to-use, context-sensitive user interfaces and a higher level of automation. But the S/4HANA solution can do much more. LAPP is one of the first medium-sized companies in Germany to also use S/4HANA financial products. For the first time, artificial intelligence is also being used here.

The SAP S/4HANA project was already in the implementation phase when LAPP took the additional decision to introduce the new S/4HANA financial products as part of this process. An additional aim was to optimise financial processes with AI and cloud solutions, making LAPP a pioneer for SMEs. Initially, a detailed concept was developed in digital workshops. The variety of new technologies and products, together with the ambitious schedule, were a major challenge for the project team…

…one that has been successfully mastered! “The new S/4HANA financial products are a real enrichment. As a result, we have been able to significantly optimise our financial processes and make them more transparent,” emphasises Biljana Dragozet, authorized signatory of U.I. Lapp GmbH. The switch to S/4HANA solutions should not only replace third-party products, but the focus was also on increasing automation and digitalisation in finance, directly from a single source, with SAP, more up-to-date and automated credit management and the use of future technologies.

The results are remarkable, as three examples of outstanding improvements prove:

- The introduction of SAP Multi-Bank Connectivity for banking communication now allows LAPP to communicate with its numerous home banks in different countries via a single interface in the SAP Cloud. The new transparency, as well as the simple and integrated control of communication in particular, minimises risks and makes the work of the specialist department enormously easier. For the first time, LAPP is able to see free liquidity across national borders on a daily basis and control it even more effectively.

- The implementation of the credit management (SAP FSCM, SAP Cloud for Credit Integration) is now realising extensive automation from collecting credit information from business partners via the connected cloud to calculating their own credit index and credit limit. The monitoring functions with real-time credit information were particularly important for LAPP. This means that risks of default on claims can continue to be well managed. Improvements in compliance through the new “documented loan decision” are also a highlight for LAPP in its new credit management, as this function enables better informed and more transparent decisions.

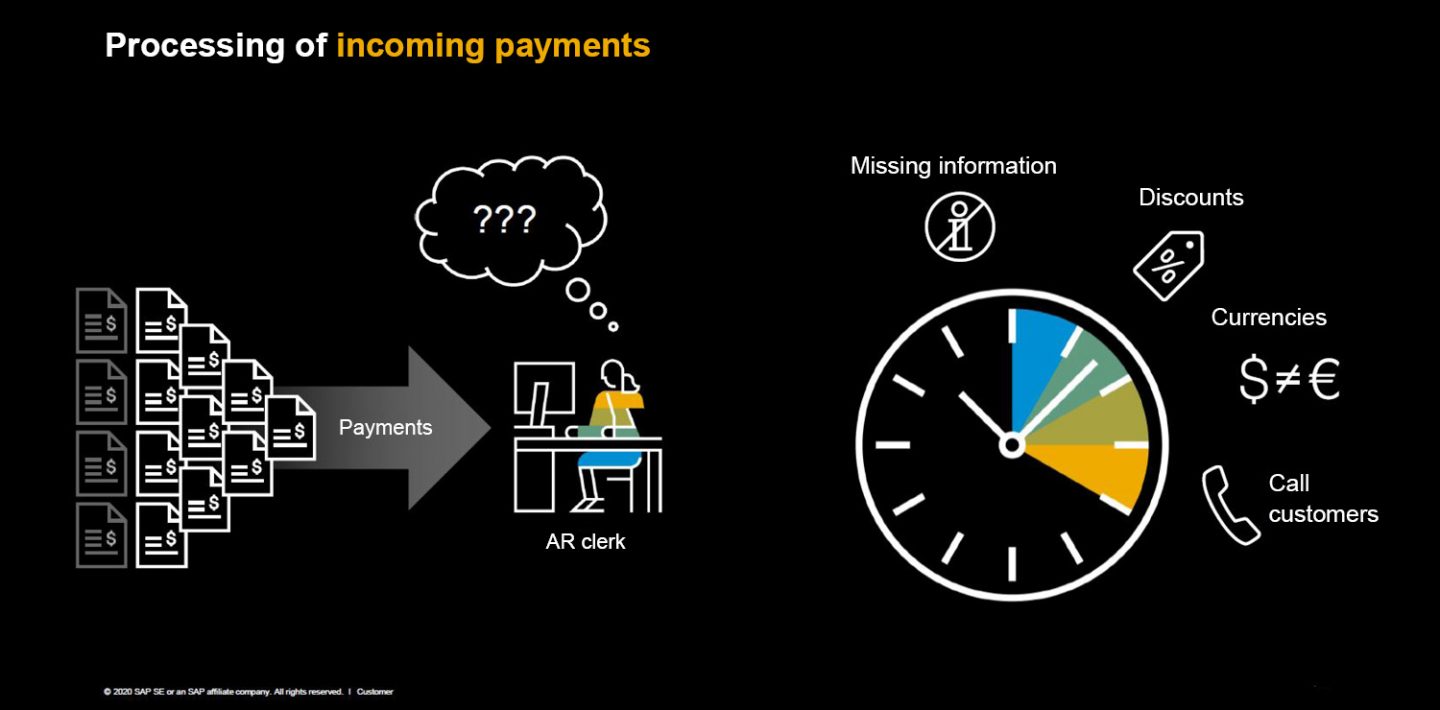

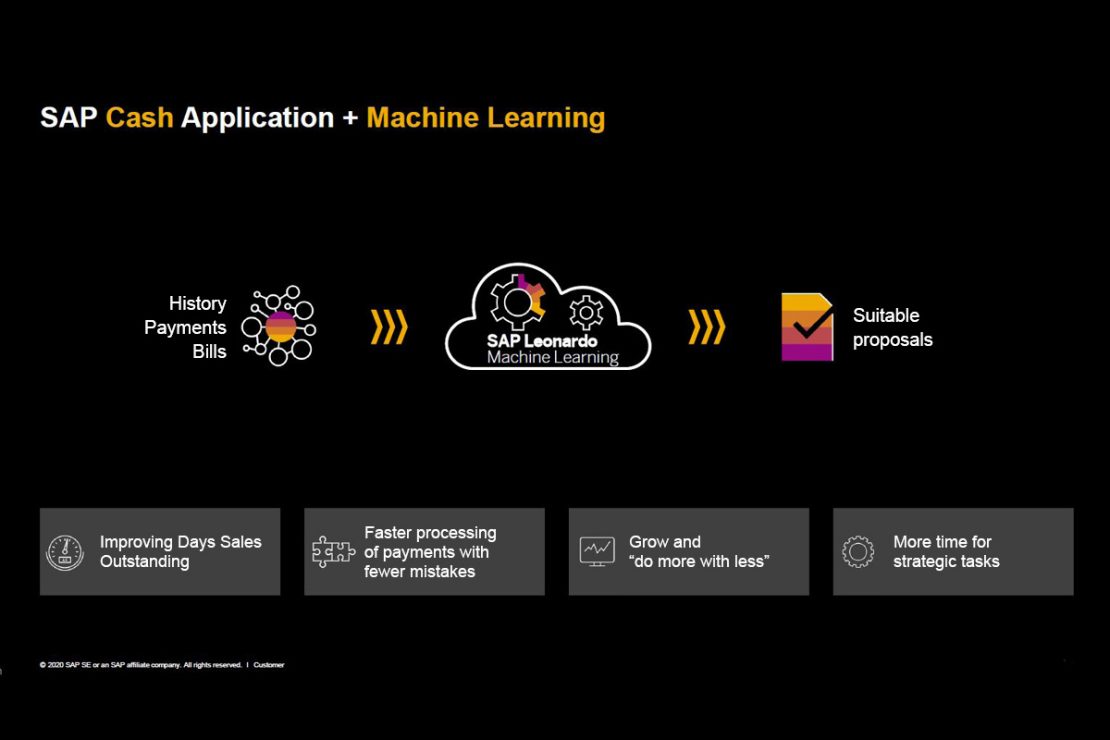

- LAPP is also one of the first medium-sized companies in Germany to use artificial intelligence for electronic invoice processing (SAP Cash Application). Account statements in account statement processing are now automatically interpreted and posted by LAPP from the cloud. The entire process is now not only quicker, but also entails less effort. OCR detection for remittance advice has now also been introduced as part of the standard with SAP Cash Application. As a result, third-party products no longer need to be integrated into this process.

Incidentally, the areas of remittance, collection management and cash management were also optimised and brought back to the SAP standard as part of the project. Thanks to the new cash management structure, LAPP now has the opportunity to analyse the cash flows in detail. With this upgrade, the S/4HANA project is making an important contribution to LAPP’s digital transformation.

Biljana Dragozet sums it up: “With the introduction of new SAP cloud solutions and state-of-the-art technologies, the finance division at LAPP is one of the company’s innovation drivers within the SAP environment.”